Trusted and flexible insurance starts here

Protection for people and businesses fast, flexible, and thoughtfully to real-life needs, challenges, and goals

Get free quote on whatsapp

Our insure partners

Our insurances that built

for your life and business

Get free quote on whatsapp

Get free quote on whatsapp

Get free quote on whatsapp

Get free quote on whatsapp

Get free quote on whatsapp

Get free quote on whatsapp

Life insurance

Protect you and your loved ones with financial security that lasts a lifetime.

Learn more

Offer secure and reliable insurance to your customers

Through our MOBY Digital Insurance Exchange, any business can seamlessly integrate insurance into their customers experience.

Renew your motor insurance and roadtax anytime, anywhere

Fast, secure, and hassle-free so you can renew with confidence and stay focused on what matters most: the road ahead.

Experience made the difference with us

Fast & Hassle-free experience

Get covered in minutes. From getting a quote to making a claim, our streamlined process saves you time and stress.

Flexible payment

Split your payments from 2 up to 36 months based on your needs enjoy greater flexibility without the added financial burden or stress.

Instant insured

Get covered in minutes with a fast, seamless insurance experience. No long forms, no waiting just instant protection.

Secure & Compliant

Your data and peace of mind are safe with us. We meet the highest industry standards for security and regulatory compliance.

Instalments payments that fit your needs

Split your payments into manageable instalments, ensuring affordability when paying for insurance

- Moby islamic(Shariah-Compliant)

- Moby(Conventional)

- Visa (12, 24 and 36 months instalment)

Testimonials

Very pleasant experience. The staff was very helpful. Everything sorted quickly and cover note and roadtax was promptly delivered after payment. Will definitely repeat.

Rohshini Vijaya

Good and fast service. Very reliable sales person. It's easy to renew your insurance and roadtax. Recommended!

Mohamed Zaid

Very satisfied with all the services that have been provided. I strongly encourage you to use Moby Insure. The staff is very helpful to me.

Aqif Faqrullah

I had great experience with Moby Insure. The staff patiently assisting with my requirements. Very polite and patient. Recommended.

Najwa Rashid

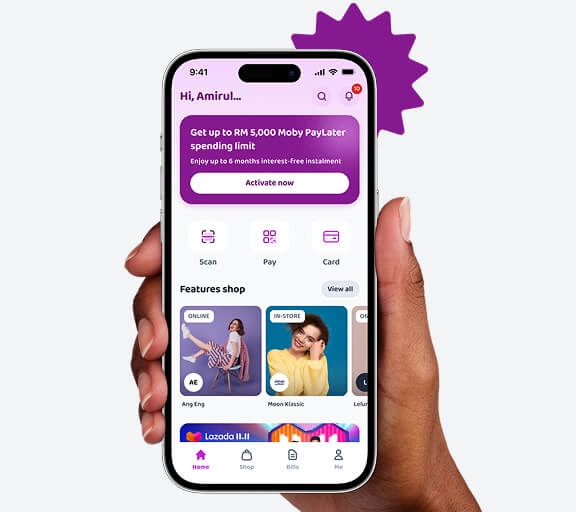

Scan, Tap, Pay and Save by Moby App

Download the Moby & Moby Islamic App to unlock exclusive rewards, vouchers, and more!

Scan to download Moby & Moby Islamic

App Store - Google Play Store

Frequently asked questions

Everything you need to know about the product and billing. Can’t find the answer you’re looking for? Please chat to our team.

A comprehensive motor insurance policy covers damage to your vehicle from a wide range of incidents, including accidents, theft, fire, vandalism, natural disasters, and damage caused to third parties. It offers the highest level of protection for your vehicle.

Comprehensive motor insurance typically does not cover:

- Wear and Tear: Damage from regular use or aging of the vehicle.

- Driving Under Influence: Accidents caused while driving under the influence of alcohol or drugs.

- Unlicensed Drivers: Accidents involving drivers without a valid license.

- Illegal Activities: Damage caused while using the vehicle for illegal activities.

- War and Terrorism: Damage due to war, civil unrest, or acts of terrorism.

- Mechanical or Electrical Breakdown: Failures not caused by an accident.

- Unauthorized Use: Damage while the vehicle is being used by someone not covered under the policy.

(Note: This list is non-exhaustive. Please refer to the policy contract for the full list of exclusions under this policy.)

Market Value coverage refers to a type of motor insurance where the compensation you receive for a claim is based on the current market value of your vehicle at the time of the loss or damage. This value is determined by the insurance company considering factors like the car’s age, make, model, and condition. It may be lower than the original purchase price or the insured value due to depreciation over time.

Agreed Value coverage is a type of motor insurance where the compensation amount is predetermined and agreed upon by both you and the insurer at the start of the policy. This agreed value does not change over time, regardless of the vehicle’s market depreciation. In the event of a total loss, such as theft or severe damage, you will be paid the agreed amount rather than the current market value.

A No-Claim Discount (NCD) is a discount on your premium for not making any claims during a policy period. The discount increases with each claim-free year, helping to reduce your insurance cost.

Any question? Talk to our advisor now

Talk to an advisorTrusted by 1,000+

customers across malaysia

We’re helping people across the nation access simple, reliable insurance solutions.